Next they find the column for married filing jointly and read down the column. First they find the 2530025350 taxable income line.

Pdf The Earned Income Tax Credit And Labor Market Participation Of Families On Welfare

Pdf The Earned Income Tax Credit And Labor Market Participation Of Families On Welfare

To figure the credit see Publication 596 Earned Income Credit.

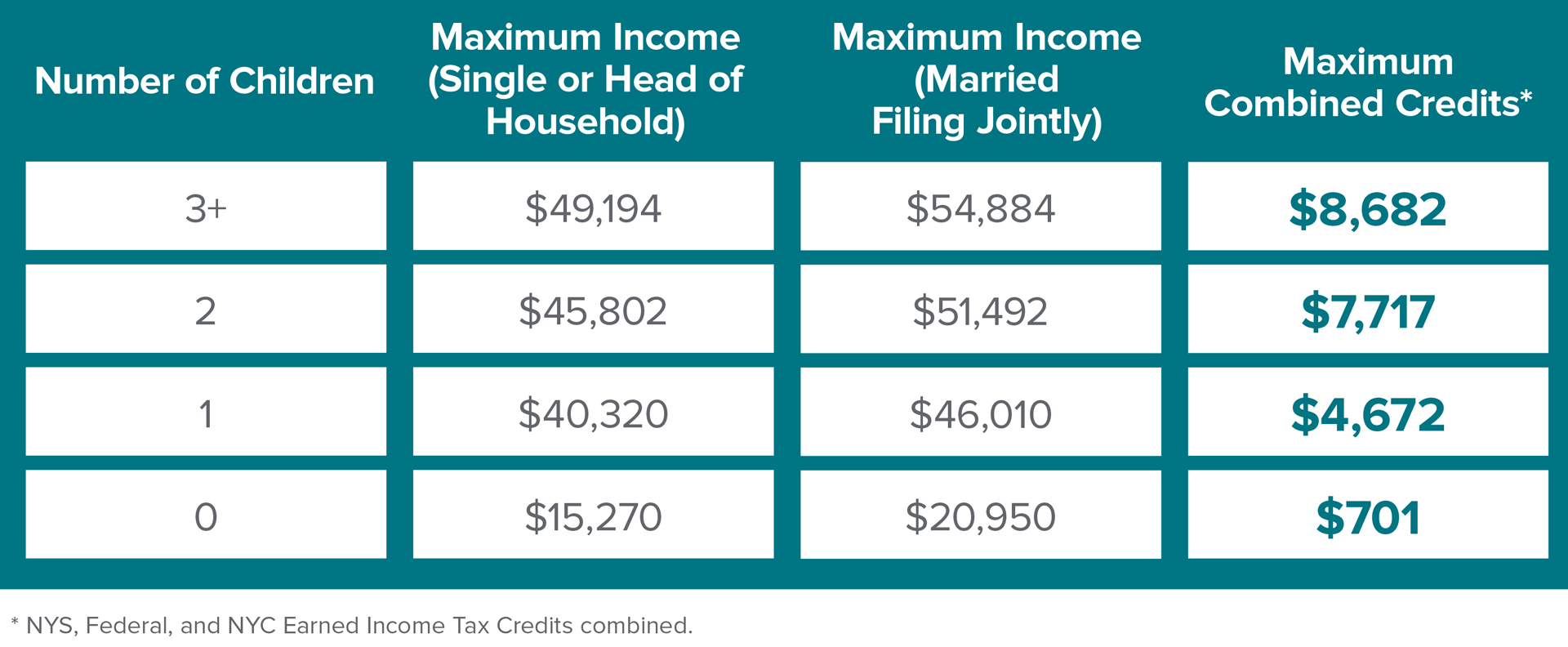

Tax bracket for earned income credit. For SingleHead of Household or Qualifying Widower Income Must be Less Than For Married Filing Jointly Income Must be Less Than Range of EITC. Earned Income Tax Credit EITC Relief. Although those without children may be eligible for a small earned income tax benefit the largest credits go to those who do have qualifying children.

Nontaxable employee pay such as certain dependent care benefits and adoption benefits is not earned income. The best Earned Income Tax bracket is for households with dependent children. If your earned income was higher in 2019 than in 2020 you can use the 2019 amount to figure your EITC for 2020.

TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Forms 1040 and 1040-SR. In 2021 the earned income credit ranges from 1502 to 6728 depending on tax-filing status income and number of children. It is a separate credit to the Employee Tax Credit in that it can also be claimed by people who are self-employed.

Those who have three or more can receive a maximum amount of 6557. THIS BOOKLET DOES NOT CONTAIN ANY TAX FORMS. Earned income generally means wages salaries tips other taxable employee pay and net earnings from self-employment.

You will then refer to the tax brackets as per your income of 38540. Under current law households with no children are eligible for a relatively small EITC with a phase-in rate of 765 percent and a maximum credit of 503. But there is an exception for nontaxable combat pay which you can choose to include in earned income.

2019 Earned Income Credit - 50 wide brackets 61219 If the If the If the amount you And you listed-- amount you And you listed-- amount you And you listed--are looking up are looking up are looking up from the One Two Three No from the One Two Three No from the One Two Three. FreeFile is the fast safe and free way to prepare and e- le your taxes. The maximum credit for other adoptions equals the amount of qualified expenses up to 14440.

The EITC was enacted in 1975 as a temporary credit to help low-income workers with children. To figure the credit see Publication 596 Earned Income Credit. The Earned Income Tax Credit EITC is a refundable tax credit targeted at low-income workers.

Children are not required to get the EITC but the biggest credit goes to those with kids who earn enough to qualify but not too much. Examples of income that qualifies for the earned income credit. 2021 Earned Income Tax Credit The maximum Earned Income Tax Credit in 2021 for single and joint filers is 543 if the filer has no children Table 5.

Earned Income Credit The Earned Income Credit is available since 1 January 2016. Earned Income Tax Credit EITC Relief. There are some eligibility criteria to qualify for an earned income credit.

The majority of benefits accrue to people with an adjusted gross income AGI under 30000 and about a third of benefits accrue to people with an AGI under 15000. The credit also increases as the number of children claimed on your tax return increases. This is the tax amount they should enter in the entry space on Form 1040 line 16.

The maximum credit is 3618 for one child 5980 for two children and 6728 for three or more children. The Adoption Credit of 14440 applies to the adoption of a child with special needs. It is allowed in respect of the pay that you earn.

If your earned income was higher in 2019 than in 2020 you can use the 2019 amount to figure your EITC for 2020. The credit is based on a percentage of your earned income but also starts to phase-out as you increase your income. Married taxpayers filing their income tax separately do not qualify for an earned income credit.

It s fast simple and secure. It has three phases. History of the Earned Income Tax Credit.

This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020. For tax year 2019. Income must be earned as an employee or from self-employed earnings.

Employee pay is earned income only if it is taxable. Earned income tax credit returns up to 6728 for married taxpayers filing jointly with three or more qualifying children. No for purposes of calculating the earned income credit child support is not considered earned income.

This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020. Three or More Children. Phaseouts apply as income rises.

The amount shown where the taxable income line and filing status column meet is 2644. So your total taxable income will be reduced to 42158 3618 38540.