Saga ranks in our top 10. By choosing only those healthcare services you need over 65s private health care neednt break the bank.

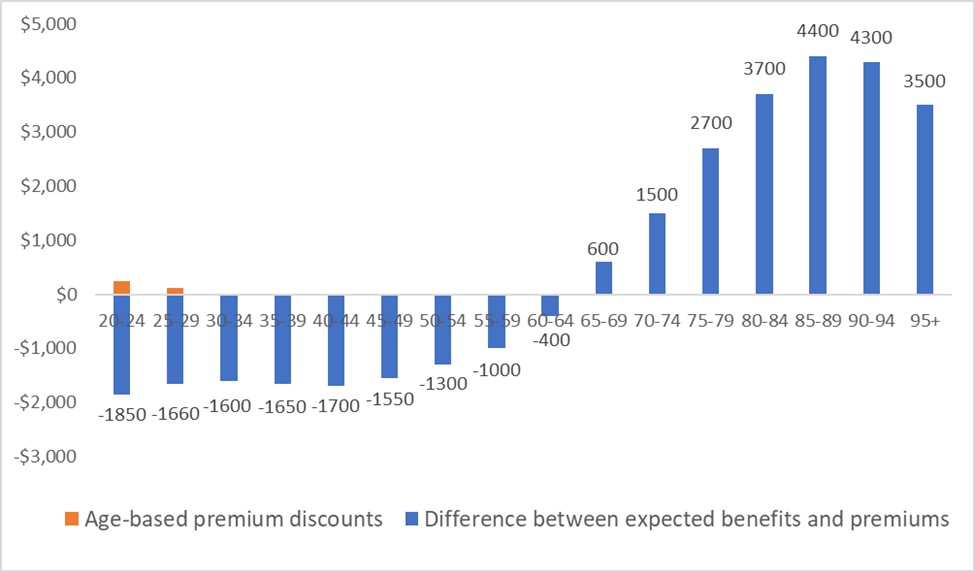

Private Hospital Insurance Premiums Should Vary By Age Insight

Private Hospital Insurance Premiums Should Vary By Age Insight

However Medicare isnt free healthcare.

Private health insurance for over 65. You can still get health insurance over 65. Ad Global Network Of 165M Hospitals And Professionals In Over 200 Countries And Territories. It can also cover younger people who have disabilities or severe health conditions.

Ad Health insurance for international students studying in Germany. Even if you have never had a policy before the market is still open for clients who are over 65. Ad Extensive Motor Insurance Policy.

Get A Quote With Cigna. Ad Health insurance for international students studying in Germany. Some of the providers that offer products that might be suitable for older customers and pensioners were praised for their customer service.

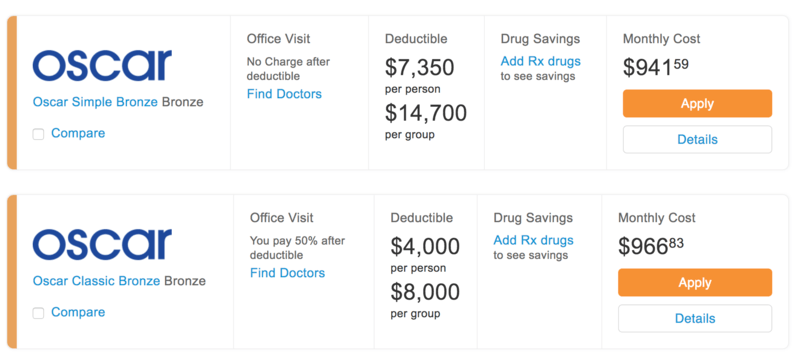

Your premium will increase as you get older because age is a risk factor. Yes private health insurance for 65 and older can be more expensive and some insurers may not provide cover above this age but for those companies that do offer more senior health insurance plans can be tailored to make them more affordable. When you reach the age of 65 there is no reason for your healthcare insurance to cease.

Medicare Part A also known as hospital insurance is designed to cover hospitalization and home health care. They will also consider where you live your medical history and the rate of medical inflation. Medicare is a federal health insurance program for people 65 and older.

It has no upper age limit although premiums do. However if the employer employs fewer than 20 people Medicare will usually be the primary. What is private health insurance and can you get private health insurance over 65.

Private health insurance pays out for private healthcare treatment if you fall ill or become injured during your policys term. If youre not yet age 65 you may qualify for coverage if you have a disability. In fact a 65-year-old couple that retired in 2019 can expect to pay 285000 in healthcare and medical expenses during their retirement.

Get Free Quotation Buy Online Now. For singles earning up to 90000 and couplesfamilies earning up to 180000 youll go from a 246 rebate to a 287 rebate. Worldwide health insurance for retired expatriates over 60 years old.

It is divided into four parts. Get Free Quotation Buy Online Now. 5 A Medigap.

Reliable And Easy Access To Quality Healthcare Around The World. This will increase to 328 at 75 from 1 April 2021. These companies are likely to have experience helping people who have similar needs to yours and they may be able to.

When you hit 65 youre entitled to a higher rebate thats the amount the government pays that helps reduce your premiums. Youre eligible for Medicare if you or your spouse worked for at least ten years in Medicare-covered employment and youre age 65 or older and a citizen or permanent resident of the United States. Get A Quote With Cigna.

Reliable And Easy Access To Quality Healthcare Around The World. For instance if you are 65 or older and have insurance through your employer or your spouses employer and that employer has 20 or more employees the rules dictate that the employers policy is the primary payer and Medicare is the secondary payer. Ad Global Network Of 165M Hospitals And Professionals In Over 200 Countries And Territories.

Insurance for age 62 to 65 Years Old Age Basic health protection is covered by most family senior health insurance over 60 protection but the factors that count are the details involved. This insurance does not fit your needs. Ad Extensive Motor Insurance Policy.

This contract can be subscribed without any age limit and offers lifetime covers. Health insurance for over 60-year-olds or 65-year olds is just health insurance thats tailored to an older age bracket. Price may be the principal bone of contention that guides your decision for purchasing a particular senior health insurance over 62 plan strategy.

WPA offers private medical insurance to people of all ages and specialises in a range of policies for the over-65s.