Speak to an Experienced Health Insurance Attorney Today This. They are often named or described with reasonable certainty in the contract of insurance.

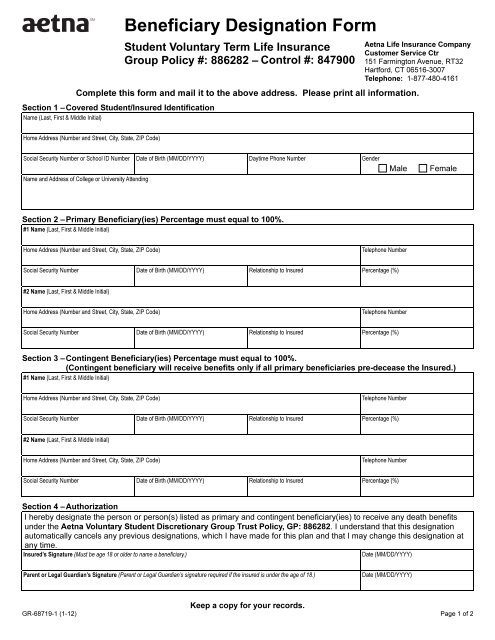

Beneficiary Designation Form University Health Plans

Beneficiary Designation Form University Health Plans

Typically any person or entity can be named a beneficiary of a.

What is a beneficiary for health insurance. The person who takes out the policy which is usually also the person who is covered is able to select a beneficiary that he or she desires. A beneficiary is someone who benefits from a gift such as from a will trust or insurance policy. In cases where the insured dies in an accident while on a trip the named beneficiary is who will receive the proceeds of the lump sum death benefit for the specified accidental death amount.

A beneficiary is the person or entity named in a life insurance policy retirement plan or health savings account. Please specify the percentage of the benefit you want to be paid to each primary beneficiary. For example if you will be including your spouse in your medical coverage and designating him or her as a recipient of your life insurance then your spouse is both a dependent and a beneficiary.

A beneficiary is the person designated or provided for by the policy terms to receive the proceeds upon the death of the insured. A primary beneficiary is a person who has been selected in a will trust or health insurance policy to be first in line to receive any designated benefits. If you dont name a beneficiary the death benefit will be paid to your estate.

Beneficiary in the context of health care means. When selecting a primary beneficiary you can name a person or persons or even a revocable trust or living trust or other legal entity. The term beneficiary refers to the specification of the recipient of funds or other benefits as specified in a policy or trust.

A person eligible for benefits under a dental plan. A beneficiary in the context of insurance is any person or legal entity who is entitled to the benefits proceeds andor earnings of a life or health insurance policy. These percentages should total 100.

Get Free Quotation Buy Online Now. A beneficiary can be a person or a legal entity that is designated by you to receive a benefit such as life insurance. When you purchase a life insurance policy you can name a beneficiary which can be a person or an entity.

These proceeds can include things like a life insurance payout or retirement account. A beneficiary is the person or entity you name in a life insurance policy to receive the death benefit. A primary beneficiary is a designated individual chosen by the policyholder who would receive the proceeds of the policy if he or she were to die.

What Is a Life Insurance Beneficiary. Two or more people. The beneficiary is enrolled in a health insurance plan and receives benefits through the policy in the form of paid claims andor network-negotiated rates for the portion of the claim that the beneficiary has to pay.

Get Free Quotation Buy Online Now. Ad Extensive Motor Insurance Policy. A beneficiary is a person or entity like a trust who will inherit proceeds upon your death.

Primary Beneficiaryies means the persons you choose to receive your insurance benefits. The term beneficiary is also used in the context of life insurance and refers to the person or people who. This is the person that receives the benefit upon death.

A person who receives benefits under a dental benefit contract. The beneficiary designation on file at the time of death is binding in the payment of your benefits. When the term contingent is used it means there are certain circumstances that must occur for the beneficiary to receive the benefit.

Ad Extensive Motor Insurance Policy. You get to choose beneficiaries for many plans or accounts when you sign up or afterward so make sure you do. Its also possible to have multiple beneficiaries If you die during the term of the policy the beneficiary receives the death benefitsometimes also called the face value.

What is a beneficiary. A person who receives benefits under health care insurance through the medicare or medicaid program. The trustee of a trust youve set up.

The beneficiary is the individual or group of individuals who receive the funds called a death payment from the life insurance policy. In contrast a contingent beneficiary is.

Counseling Beneficiaries On Private Group And Employersponsored Health

Counseling Beneficiaries On Private Group And Employersponsored Health

All You Need To Know About Insurance Whole Life Insurance Health Insurance Options Life Insurance Beneficiary

All You Need To Know About Insurance Whole Life Insurance Health Insurance Options Life Insurance Beneficiary

Question 1 The Members Of A Health Insurance Sche Chegg Com

Question 1 The Members Of A Health Insurance Sche Chegg Com

Options To Educate And Empower Health Insurance Beneficiaries Download Scientific Diagram

Options To Educate And Empower Health Insurance Beneficiaries Download Scientific Diagram

What Is A Beneficiary In A Life Insurance Policy And How To Select The Right One Life Insurance Policy Insurance Policy Life Insurance Beneficiary

What Is A Beneficiary In A Life Insurance Policy And How To Select The Right One Life Insurance Policy Insurance Policy Life Insurance Beneficiary

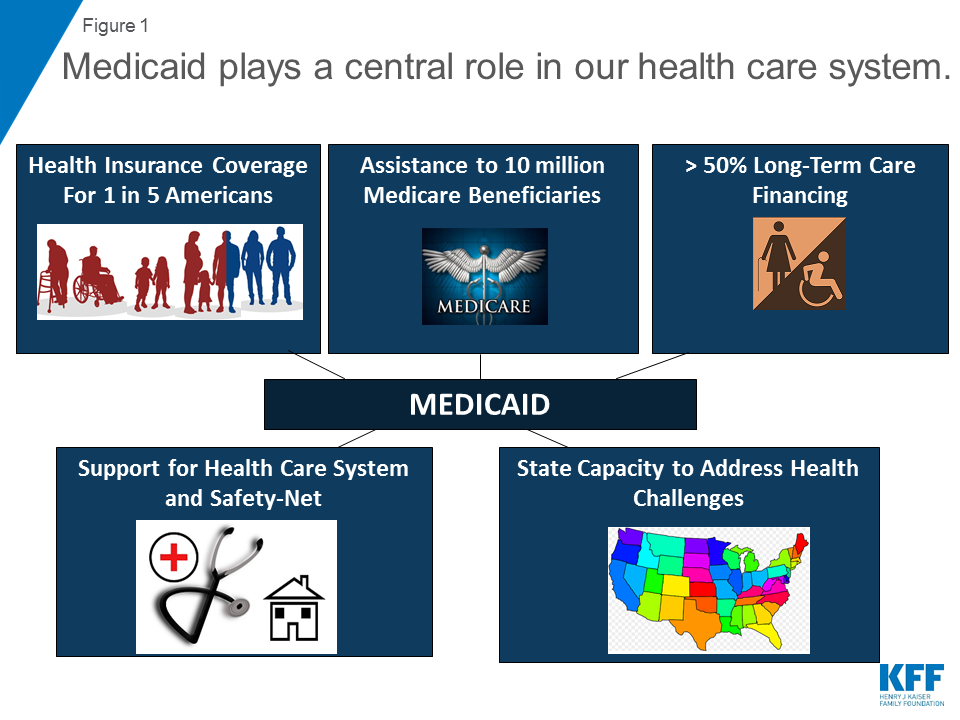

10 Things To Know About Medicaid Setting The Facts Straight Kff

10 Things To Know About Medicaid Setting The Facts Straight Kff

Https Www Social Protection Org Gimi Ressourcepdf Action Ressource Ressourceid 53144

3 Ways To Add A Spouse To Health Insurance Wikihow

3 Ways To Add A Spouse To Health Insurance Wikihow

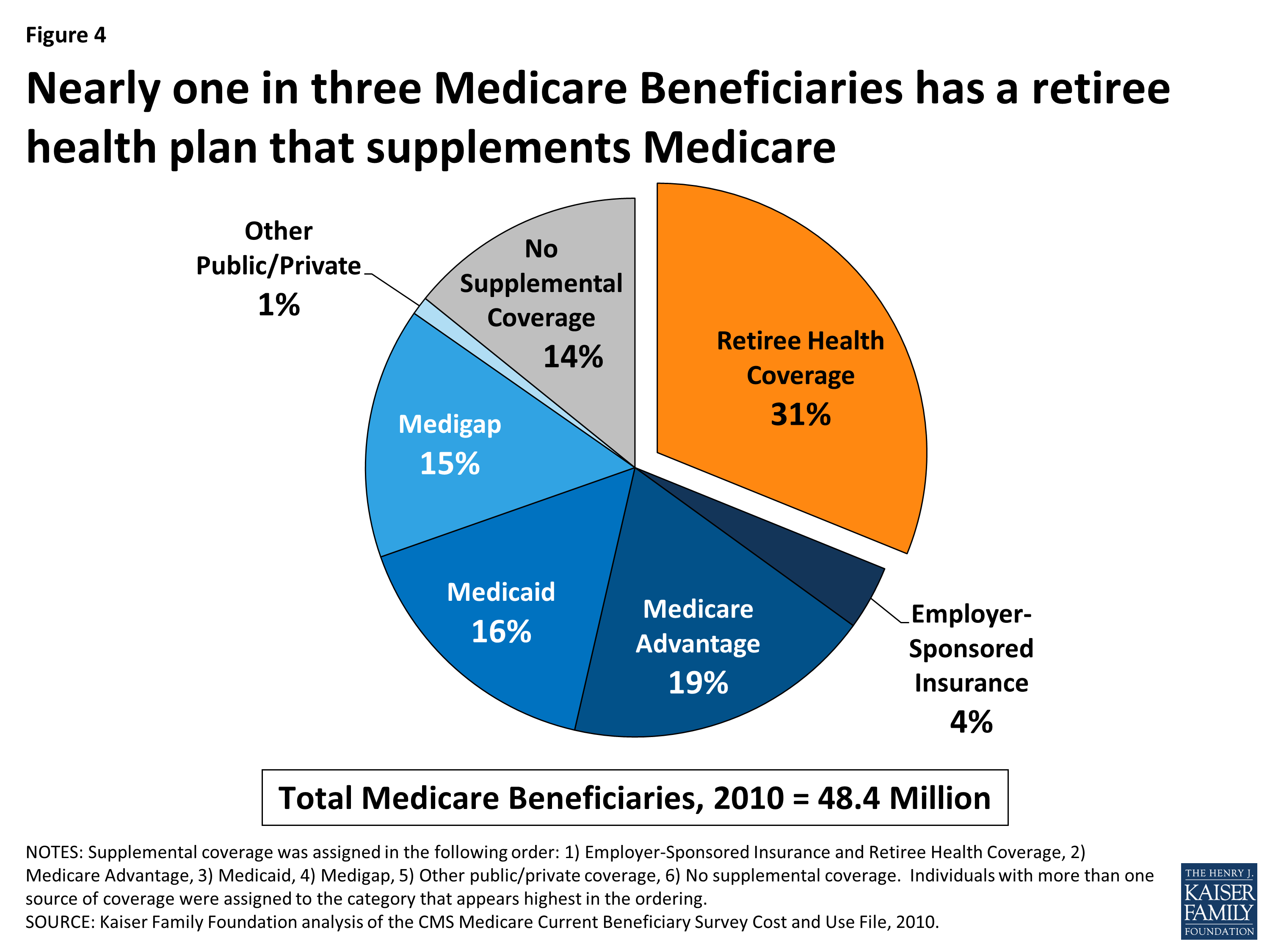

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Retiree Health Benefits At The Crossroads Overview Of Health Benefits For Pre 65 And Medicare Eligible Retirees 8576 Kff

Health Information Protected By The Health Insurance Portability And Download Scientific Diagram

Health Information Protected By The Health Insurance Portability And Download Scientific Diagram

Pdf Comparative Analysis Of Health Insurance Systems In The United States And South Korea

Pdf Comparative Analysis Of Health Insurance Systems In The United States And South Korea

Health Insurance Questionnaire Pdf Pdf Format E Database Org

Health Insurance Questionnaire Pdf Pdf Format E Database Org

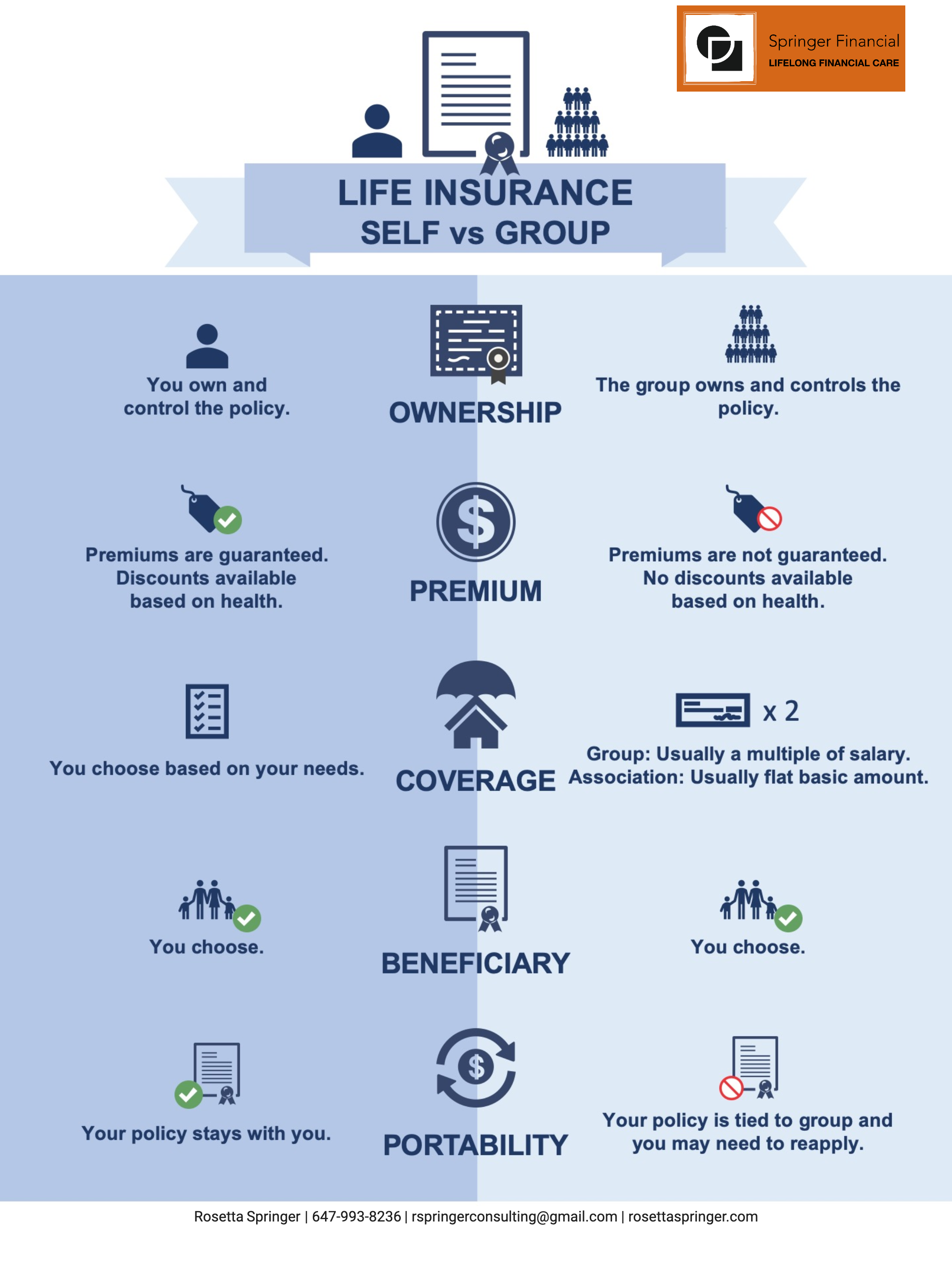

Group Insurance Vs Individual Life Insurance

Group Insurance Vs Individual Life Insurance

The Health Care Handbook Ppt Download

The Health Care Handbook Ppt Download

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.