There is a simple formula which can be used to calculate risk. Where different returns from an asset are possible under different circumstances more than one forecast of the future returns may.

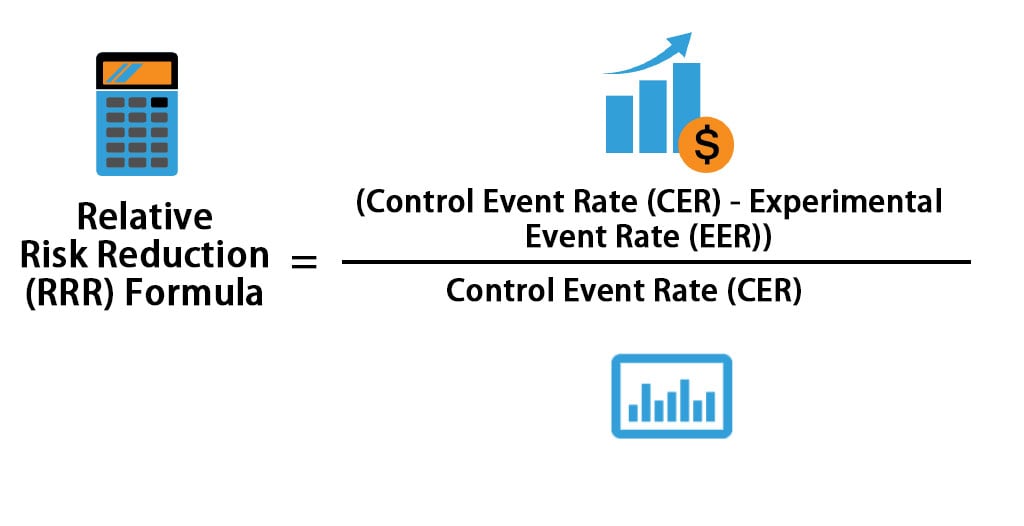

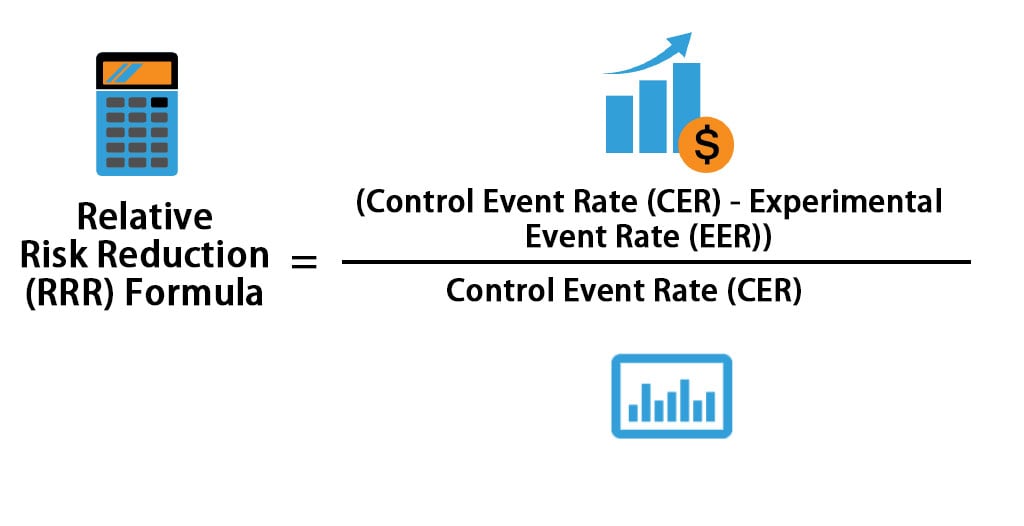

Relative Risk Reduction Formula Calculator Excel Template

Relative Risk Reduction Formula Calculator Excel Template

Here Risk Premium is calculated using formula.

Risk calculation formula. This article throws light upon the top four methods of measurement of risk. Using the example above the risk score would be calculated. Risk Likelihood x Severity.

Risk Premium formula helps to get a rough estimate of expected returns on a relatively risky investment as compared to that earned on a risk-free investment. Likelihood and Severity are usually given values of between 1 and 3 or 1 and 5 resulting in a grid. Determine additional countermeasures needed to fill the remaining gap in vulnerabilities prioritized by the risk calculation previously Fig.

Quantitative Risk Assessments Formula. This gives us a simple formula to measure the level of risk in any situation. In the first example risk free rate is 8 and the expected returns are 15.

Evaluate the Hazards and Risk. So we can see that the risk scoring calculation can have a fairly substantial impact on how the risk is assessed. The weights of the two assets are 60 and 40 respectively.

Risk threat x vulnerabilities x probability x impactcountermeasures Understanding and calculating risk allows an organization to better understand their points of exposure. AR absolute risk the number of events good or bad in treated or control groups divided by the number of people in that group ARC the AR of events in the control group ART the AR of events in the treatment group ARR absolute risk reduction ARC ART. Formula to Calculate Risk Premium The risk premium is calculated by subtracting the return on risk-free investment from the return on investment.

Capital is a banks core capital that is used at times of financial emergency. You invested 60000 in asset 1 that produced 20 returns and 40000 in asset 2 that produced 12 returns. Calculate the risk of attack.

Therefore Risk-Weighted Assets Tier 1 Capital Tier 2 Capital Capital Adequacy Ratio. In the second example risk free rate is 8 and expected returns is 95. You can easily calculate the Risk Premium using Formula in the template provided.

From the above formula it is clear that the calculation of risk ratio takes the incidence or risk of the event taking place in one group experimental group and draws a comparison with the incidence or risk of the event taking place in another group control group. Review and Revise. The portfolio returns will be.

RP 06020 04012 168. Risk Probability P x Consequence C Risk Score P x C. Identify the People at Risk.

Risk Score Probability 5 x 432 5 x 3 15. Lets take a simple example. Capital Adequacy Ratio Tier 1 Capital Tier 2 Capital Risk-Weighted Assets.

This takes the probability and multiples it by the average score of all risk impacts. Risk consequences likelihood. This is performed by examining two variables.

Risk can be defined as the combination of the probability of an event occurring and the consequences if that event does occur. Risk Premium Formula Ra Rf.