To qualify you must meet certain requirements. Taxpayers with low earnings by reducing the amount of tax owed on a dollar-for-dollar basis.

Expanding The Earned Income Tax Credit Can Support Older Working Americans Urban Institute

Expanding The Earned Income Tax Credit Can Support Older Working Americans Urban Institute

The EIC provides support for low and moderate-income working parents with qualifying children in the form of tax credits.

Eic tax credit. The EITC is a refundable tax credit which means it can reduce the amount of taxes you owe and generate a refund. In 2021 more hard-working individuals and families are eligible than ever including Californians that file their taxes with. The EITC is based on a percentage of.

The earned income credit EIC is a refundable tax credit that helps certain US. The EITC reduces the taxes you owe and may even give you a refund. Married and unmarried taxpayers alike can qualify.

The EIC may also give you a refund. This year the EITC is getting a second look from taxpayers because many have experienced income changes due to COVID-19. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children.

Did you receive a letter from the IRS about the EITC. What is the Earned Income Tax Credit EITC or EIC. The Earned Income Tax Credit or EIC is aimed at working taxpayers with low to moderate levels of income.

The earned income credit EIC is a tax credit for certain people who work and have earned income under 56844. The Earned Income Tax Credit EITC is a refundable tax credit targeted at low-income workers. A tax credit usually means more money in your pocket.

The Earned Income Tax Credit EITC or EIC is a benefit for working people with low to moderate income. The Earned Income Tax Credit - EITC or EIC. The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people.

The Earned Income Tax Credit EITC or Earned Income Credit EIC is a refundable tax credit targeted to working people with low to moderate income. During 2019 25 million taxpayers received about 63 billing in Earned Income Credit. For a person or couple to claim one or more persons as their qualifying child requirements such as.

The EITC is a significant tax credit for lower and lower-middle income taxpayers that rewards earned income particularly for those with children. The Earned Income Tax Credit EIC or EITC is a refundable tax credit for low- and moderate-income. The earned income tax credit is available to taxpayers with low and moderate incomes.

How Does the Earned Income Credit Work. The Earned Income Tax Credit - EITC or EIC - is a refundable tax credit aimed at helping families with low-to-moderate earned income. The earned income tax credit is a tax credit meant to help working people with low or moderate incomes.

It reduces the amount of tax you owe. The credit decreases the amount of tax you owe and the credit is refundable you can get a refund even if your tax liability what you owe reaches 0. The majority of benefits accrue to people with an adjusted gross income AGI under 30000 and about a third of benefits accrue to people with an AGI under 15000.

Find out what to do. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. You can only qualify for the EITC if.

The California Earned Income Tax Credit CalEITC is a refundable cash back tax credit for qualified low-to-moderate income Californians. In 2019 25 million taxpayers received about 63 billion in earned income credits. You may claim the EITC if your income is low- to moderate.

It was first enacted under the Ford administration in 1975 and was built with the dual purpose of incentivizing the earning of income and reducing poverty. The earned income tax credit is available to claim for the 2020 2021 tax season. Claiming the credit when you file your taxes may reduce how much you owe or better yet.

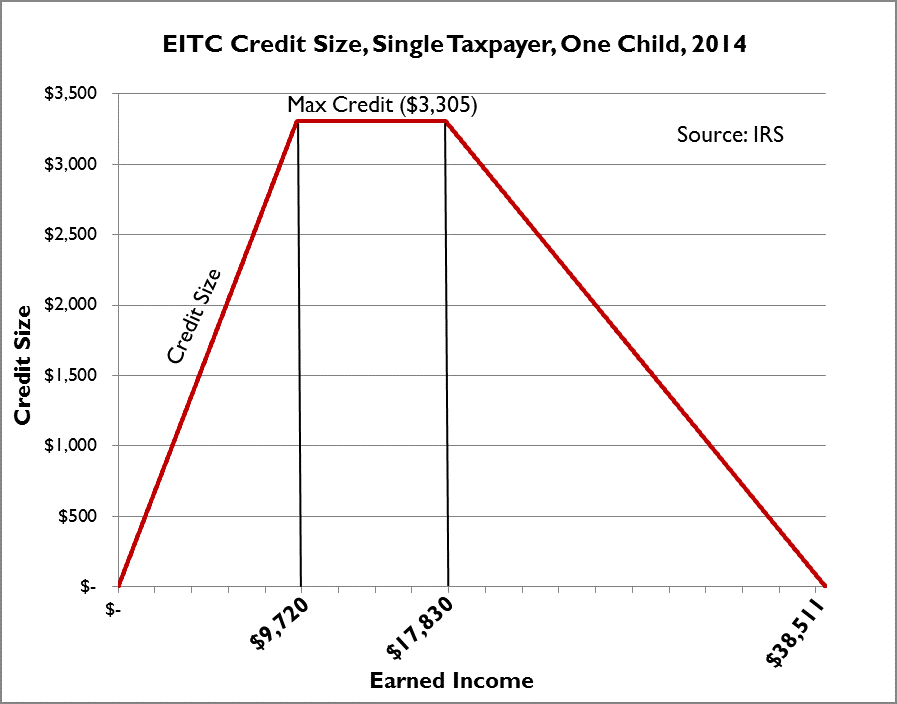

It has three phases. The IRS estimates that about 15 of eligible individuals do not claim this tax credit. You must also file a tax return even if you dont owe any taxes or are not required to file.

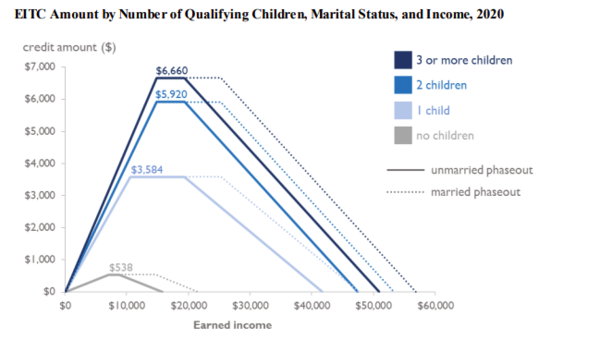

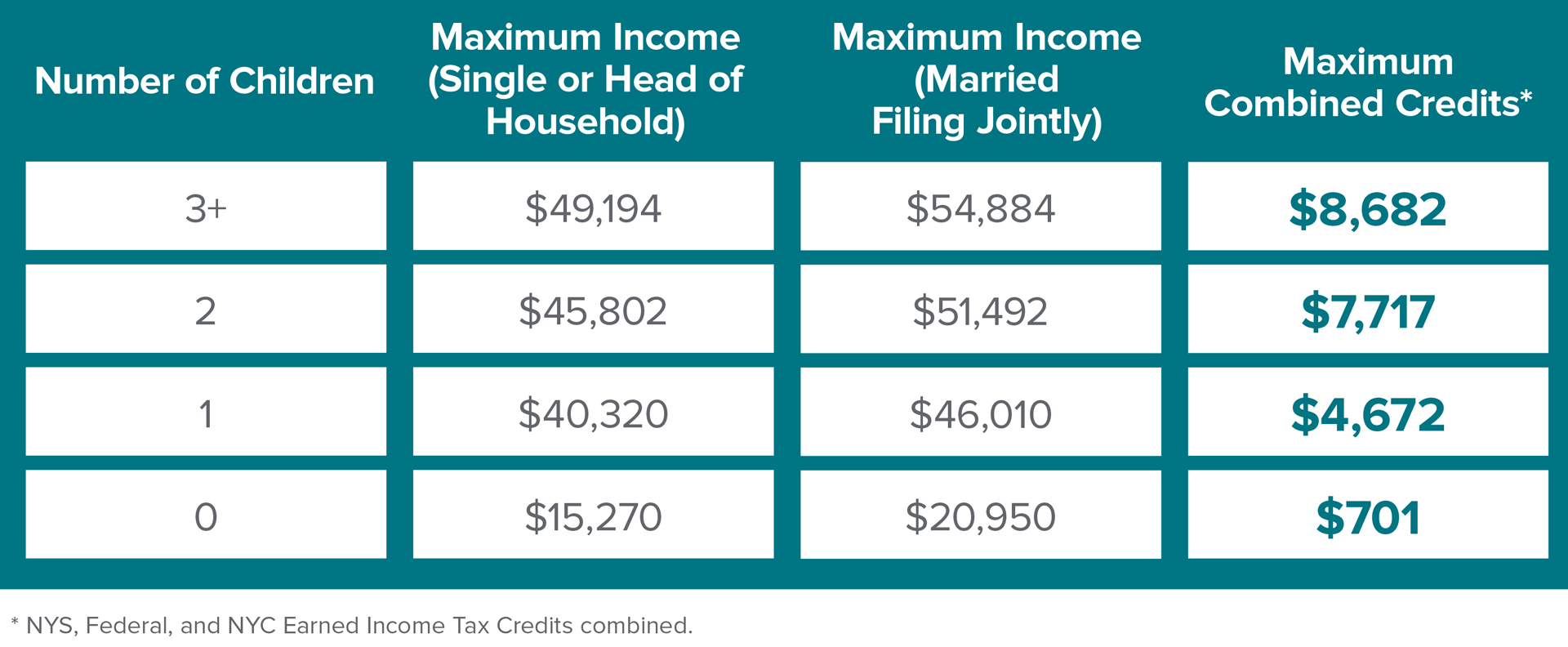

If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. The amount of EITC benefit depends on a recipients income and number of children.

The Earned Income Tax Credit Helping Families At A Surprisingly Low Cost

The Earned Income Tax Credit Helping Families At A Surprisingly Low Cost

Earned Income Tax Credit Wikipedia

Earned Income Tax Credit Wikipedia

Earned Income Tax Credit Wikipedia

Earned Income Tax Credit Wikipedia

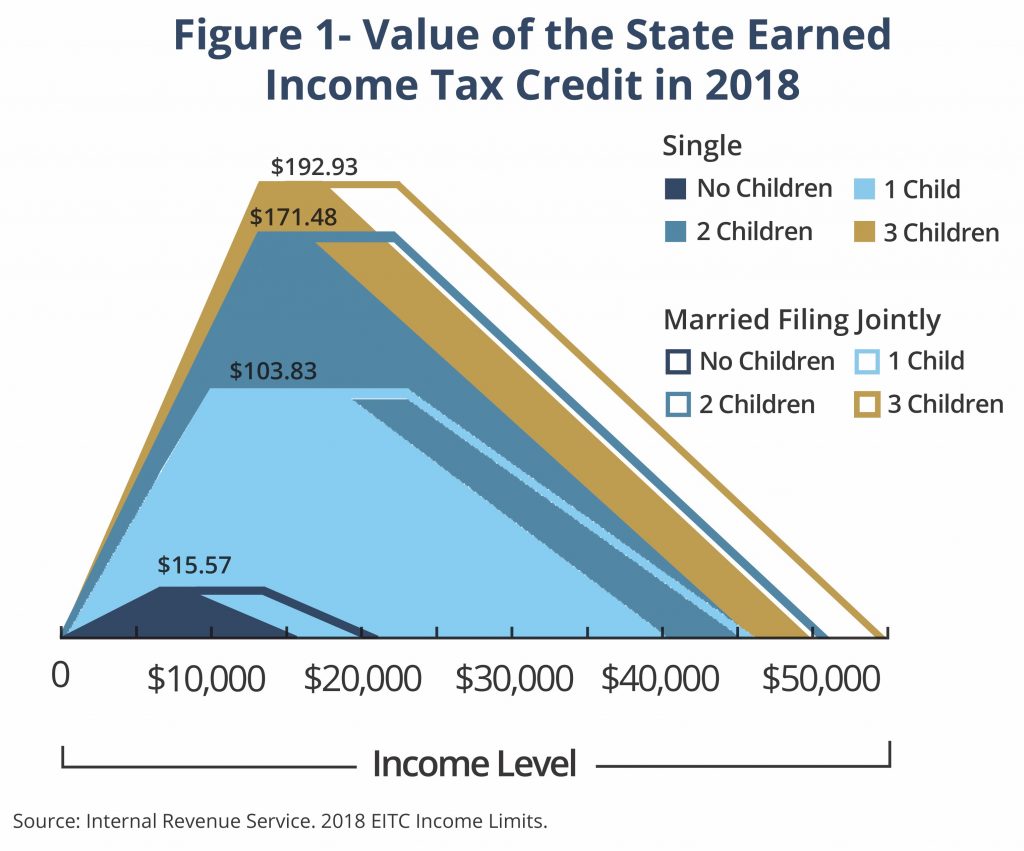

A State Earned Income Tax Credit Helping Montana S Working Families And Economy Montana Budget Policy Center

A State Earned Income Tax Credit Helping Montana S Working Families And Economy Montana Budget Policy Center

What Is The Earned Income Tax Credit Tax Policy Center

What Is The Earned Income Tax Credit Tax Policy Center

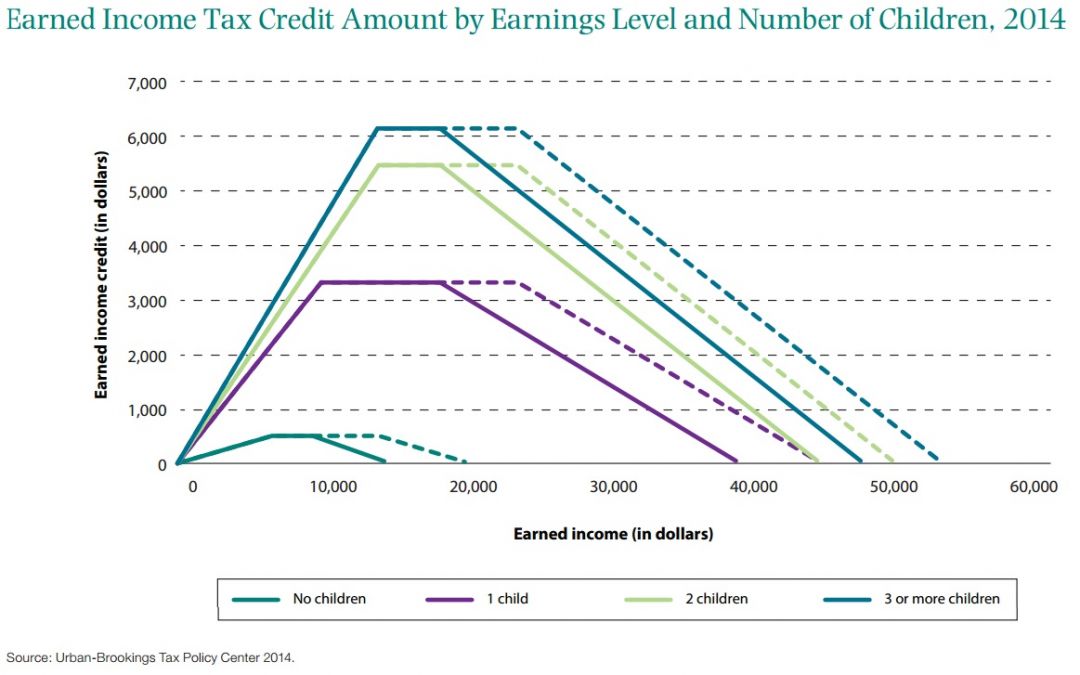

Earned Income Tax Credit Amount By Earnings Level And Number Of Children 2014 The Hamilton Project

Earned Income Tax Credit Amount By Earnings Level And Number Of Children 2014 The Hamilton Project

Eitc A State Tax Credit For Working Families North Carolina Justice Center

Eitc A State Tax Credit For Working Families North Carolina Justice Center

Are You One Of The 380 000 Taxpayers Missing Out On Billions In Tax Credits

Are You One Of The 380 000 Taxpayers Missing Out On Billions In Tax Credits

Overview Of The Earned Income Tax Credit On Eitc Awareness Day Tax Foundation

Overview Of The Earned Income Tax Credit On Eitc Awareness Day Tax Foundation

Earned Income Tax Credit Reform Eitc Reform Tax Foundation

Earned Income Tax Credit Reform Eitc Reform Tax Foundation

Earned Income Tax Credit Estimator Get It Back Tax Credits For People Who Work

Earned Income Tax Credit Estimator Get It Back Tax Credits For People Who Work

How Does The Earned Income Tax Credit Affect Poor Families United Way Of Treasure Valley

How Does The Earned Income Tax Credit Affect Poor Families United Way Of Treasure Valley

Maximizing The Earned Income Tax Credit Internal Revenue Service

Maximizing The Earned Income Tax Credit Internal Revenue Service

Earned Income Tax Credit Eitc A Primer Tax Foundation

Earned Income Tax Credit Eitc A Primer Tax Foundation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.